How to Buy a Home While on Active Military Duty in Honolulu Hawaii

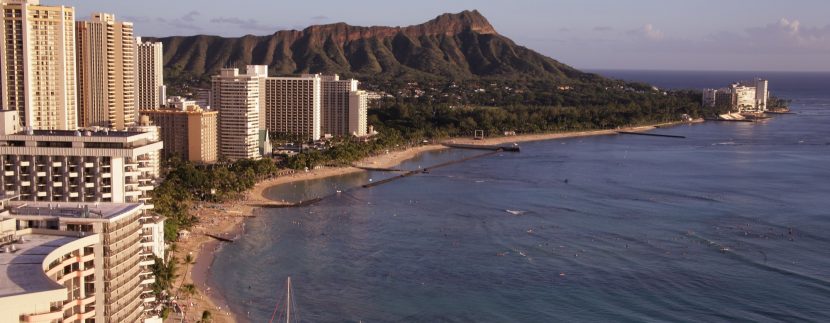

Being assigned to Honolulu when you’re on active military duty can be a dream come true. You get to experience island living while in a beautiful location.

In addition to living in paradise, being assigned to Hawaii can come with other benefits – you can buy a home. Your home in Honolulu could potentially appreciate in value while you’re stationed there, sometimes thousands of dollars. You’ll also get to take advantage of military loans and mortgage assistance programs.

This guide will go over everything you need to know when buying a home in Hawaii when you’re on active duty. Working with a qualified military realtor in Hawaii will also guarantee you’re getting the best deal possible.

Benefits of Buying a Home While on Active Duty

Before we get started on how to navigate Hawaii military realty, let’s talk about the benefits of purchasing a home instead of renting or living on base. Like we mentioned before, you could make thousands of dollars when you sell your home.

With a Veterans Administration (VA) loan, you won’t need a down payment. You don’t have to spend years saving or spend your hard-earned money in order to qualify for a VA loan.

Additionally, you can use your Basic Allowance for Housing (BAH) toward your monthly mortgage payment. The BAH you receive to rent in Oahu is oftentimes more than enough to fully cover a monthly mortgage payment. Put your BAH toward a home that you could potentially make a profit off of when you sell it.

When you buy a home, you don’t have to worry about your rent costs going up. Your mortgage payments will likely be less than your monthly rent would be as well.

You’re free to make any changes and modifications to the home that you’d like. Work with a qualified military realtor in Oahu to find your perfect island sanctuary.

Advantages of Using VA Financing

The main benefit of getting a VA loan, as we mentioned, is not needing a down payment to qualify. The loan is also guaranteed by the federal government. That means you’re not required to get private mortgage insurance (PMI).

Not needing PMI will also decrease your monthly mortgage payment. You’ll be able to afford a home at a higher price without having to worry about some of your money each month going toward the PMI.

With a VA loan, the closings costs are typically lower than those of a conventional mortgage. You’re also able to look at purchasing short-sale and foreclosed homes. The home just needs to meet the VA’s appraisal standards and you’ll have no problem at all.

Choosing the right VA lender is also an important part of the process. There are so many mortgage companies on the market. It can be hard to determine which is the best one for you.

You should look for a lender that has a lot of experience with VA loans. Working with a realtor in Honolulu that has a lot of experience with military loans will ensure the process goes smoothly.

Do Your Research and Homework

It’s important to understand all the requirements and fees that come with a VA loan. You also want your realtor in Hawaii to be well versed in them. If they don’t understand them, you should look for one that is more qualified.

Some of the requirements for a VA loan include a strong credit score and a high enough income to qualify for the loan. You also need to apply for a VA home loan Certificate of Eligibility. This confirms to the mortgage lender that you qualify for that type of loan.

After your VA loan eligibility has been established, you’ll have to have all of your military service documentation at the ready. You’ll need to officially request your military service records by filling out a DD2214 form.

Once all your documents are ready and submitted, you can begin approaching lenders to see how much of a VA loan you qualify for. REMAX Oahu can connect you with a qualified military realtor that is experienced in this area. They’ll be able to connect you to the best lender possible for purchasing a home.

Strategize for the Future

Buying a home in Honolulu is different than buying one on the mainland. The hefty price tag is one of the main differences between the two. That’s because land is limited on the island, so there are smaller houses on small lots that cost more.

In some parts of the United States, you can spend a few hundred thousand dollars and get a house that’s several thousand square feet big. That’s not the case on Oahu. You’ll have to manage your expectations for what you think your money can buy you in Honolulu.

When figuring out your long-term strategy, you should think about what you’ll do with the home when it’s time to leave Oahu. You want to have a plan in place even before you purchase the home.

If you decide to keep your home when you move back to the mainland, you might consider talking to your realtor about property management services. You also might want to resell the home so you can use the profit toward a home on the mainland.

Partnering with an expert realtor in Honolulu will ensure this process goes smoothly for you. There are many ins and outs with purchasing a home as an active duty individual. Let a professional guide you through the process.

Buy a Home With Confidence With a Realtor in Honolulu

Deciding to buy a home is a big step that should be handled with care. Partnering with a qualified realtor in Oahu will ensure you find the home of your dreams. You’ll also be sure you take advantage of every opportunity the military has to offer for homeowners.

Contact REMAX Honolulu today to speak with Shannon Severance about Hawaii military relocation.